The question of are you required to have insurance on a boat is one that floats through the mind of nearly every new and seasoned mariner. While you might think the answer is a simple yes or no, the reality is a bit more nuanced, tangled in a net of local regulations, financing agreements, and private facility rules. Understanding this landscape isn’t just about compliance; it’s about safeguarding your investment, your financial well-being, and your peace of mind on the water. The core of the issue often extends beyond a simple mandate to encompass essential protections like liability coverage, which can be dictated by specific state laws and strict marina requirements.

For many boaters, the type of vessel they own can significantly influence the rules they must follow. While a small kayak might have minimal requirements, powerful personal watercraft often come with their own set of regulations. For anyone who owns or is thinking about a jet ski, exploring the specifics for a moto acuatica can provide valuable, vessel-specific insight into these different expectations.

The Legal Landscape: Is Boat Insurance Mandated by Law?

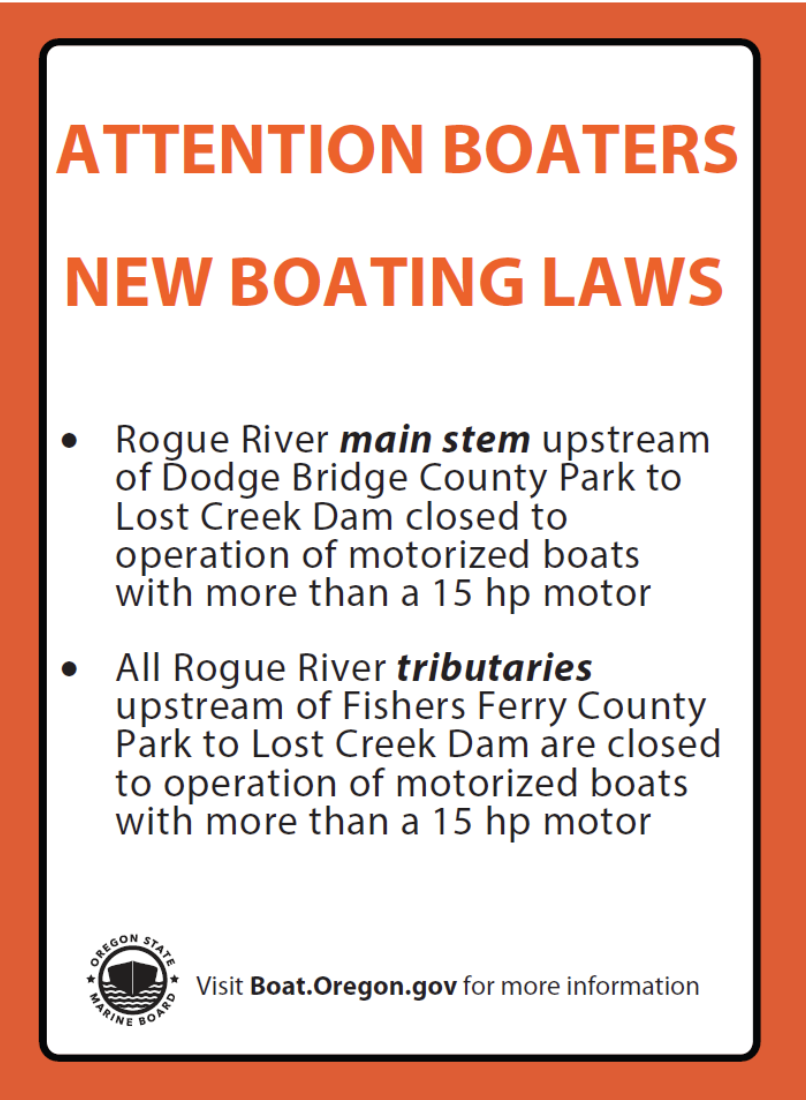

When you get down to brass tacks, very few states in the US or regions in the UK have a blanket law that legally requires every boat owner to carry insurance for a privately owned recreational vessel. Unlike car insurance, which is a near-universal legal mandate for driving on public roads, boating laws are often less stringent. Only a handful of states, such as Arkansas and Utah, have specific minimum liability insurance requirements for certain types of boats, usually those with more powerful engines.

However, this lack of a universal law can be misleading. The absence of a statewide requirement does not mean you can or should go without coverage. The legal framework is just one piece of the puzzle. The practical realities of boat ownership, from where you store your vessel to how you paid for it, often create a web of obligations that make insurance a de facto necessity for the vast majority of owners.

When Does a ‘No’ Become a ‘Yes’? Indirect Requirements for Boat Insurance

Even if your local government doesn’t force your hand, other powerful entities almost certainly will. The most common scenario is financing. If you’ve taken out a loan to purchase your boat, your lender will absolutely require you to carry comprehensive insurance that covers the full value of the vessel. From their perspective, the boat is their collateral, and they need to protect their investment against damage, theft, or total loss until the loan is fully paid off. Failing to maintain this coverage is a direct violation of most loan agreements and can lead to serious consequences.

Another major player is the marina or yacht club where you plan to moor your boat. Virtually every commercial marina will require you to provide proof of liability insurance before they will even consider offering you a slip. They need to protect themselves, their property, and their other clients from potential damages you might cause. Imagine a scenario where your boat breaks free from its moorings during a storm and damages several other expensive vessels—without liability coverage, the financial fallout could be catastrophic.

As marine surveyor Captain Alistair Finch often remarks, “I’ve seen more financial shipwrecks on land from lawsuits than I’ve seen actual shipwrecks at sea. Liability insurance isn’t a luxury; it’s the single most important piece of safety gear a boat owner can have.”

What Types of Boat Insurance Coverage Should You Consider?

Once you accept that insurance is a practical necessity, the next step is understanding what kind of coverage you need. A typical watercraft policy is a package of different protections. Liability coverage is the foundation, covering bodily injury or property damage you may cause to others. This could include injuries to swimmers, damage to other boats, or damage to a dock. It’s the part of the policy that protects your personal assets in the event of a lawsuit.

Beyond liability, you’ll want physical damage coverage, which is often split into two parts: hull insurance and machinery insurance. This protects your actual boat against events like collision, fire, theft, and storm damage. Other valuable add-ons include uninsured/underinsured watercraft coverage, which protects you if you’re in an accident caused by a boater with insufficient or no insurance. You might also consider coverage for personal effects, fuel spills, and on-water towing. Understanding the mechanics of securing your vessel is also key to preventing claims, making knowledge of proper ancrage pour bateau not just a practical skill but a financial safeguard.

How Do Factors Like Your Boat and Location Affect Your Policy?

Not all boat insurance policies are created equal, and the price you pay will be influenced by a variety of factors. The size, type, age, and horsepower of your boat are primary considerations. A high-performance speedboat will naturally command a higher premium than a small fishing boat. Insurers will also look at your boating experience and claims history. A clean record and completion of a boating safety course can often lead to significant discounts.

Where you plan to use your boat is another critical factor. A boater on a small, calm inland lake will face different risks—and a different premium—than someone navigating the hurricane-prone coastal waters of Florida or the busy shipping lanes of the English Channel. The policy’s navigational limits will explicitly state where your boat is covered, and venturing outside this area could void your policy. This is similar to how other regulations are applied; for example, understanding the rules for a personal watercraft is a common concern, and many boaters ask, “se necesita licencia para manejar jet ski” which highlights how location and vessel type dictate the rules.

Beyond the Boat: Does Your Dock or Marina Have Its Own Insurance Needs?

Your responsibility doesn’t end at the waterline. If you own a private dock, it’s crucial to understand how it is covered. Most standard homeowner’s insurance policies offer very limited or no coverage for marine structures like docks, piers, and boat lifts, especially for damage caused by ice, high winds, or waves. You may need a separate endorsement on your homeowner’s policy or a specific marine policy to adequately protect these expensive structures. A well-constructed dock is the first line of defense, and for those building their own, having solid boat docks plans is essential for both safety and insurability.

For larger community marinas or commercial operations, the infrastructure needs are even greater and more complex. These facilities rely on specialized systems to function safely and efficiently, from fuel depots to waste management. The integrity of this infrastructure is paramount, and elements like well-maintained floating pontoon pump stations are critical components that require their own specific insurance and maintenance considerations to prevent environmental and financial disasters.

Captain Finch adds, “Boaters often forget that their risk profile includes everything attached to their boat, including the dock it’s tied to. A dock failure can be just as costly as a collision on the water. Check both your homeowner’s and your boat policy to see where you’re covered and, more importantly, where you’re not.”

So, while the direct answer to are you required to have insurance on a boat might be “it depends on where you are,” the practical, real-world answer for any responsible boat owner is a resounding “yes.” It is an essential tool for protecting your boat, your finances, and your ability to continue enjoying your time on the water without worry. It’s less of a legal burden and more of a fundamental part of smart, safe, and sustainable boat ownership.

Comments

Charlotte Evans

★★★★★

This article was incredibly helpful. As a new boat owner, I was so confused about the insurance requirements. This broke it down perfectly and helped me understand that even if it’s not a state law, my marina and bank make it a necessity. Thank you for the clear explanation!

David Chen

★★★★★

Excellent and accurate information. I’ve been boating for over 20 years, and the point about marinas requiring liability insurance is spot on. I’ve seen people turned away at the dockmaster’s office for not having their paperwork in order. This should be required reading for anyone buying a boat.

Marco Bianchi

★★★★☆

Wish I had read this a few years ago. I learned the hard way after a storm damaged my uninsured boat while it was moored. The cost of repairs was astronomical. This guide is right—treating insurance as optional is a gamble you’ll eventually lose. Great read.

Priya Patel

★★★★☆

This is a really thorough guide. It covers all the angles I was wondering about. Does anyone know if taking a US Coast Guard Auxiliary safety course typically gives a big discount on your premium? My friend mentioned it but I’m not sure how much it actually helps.

Liam O’Connell

★★★★★

As a boater in Florida, this article is 100% correct. Down here, with the hurricane risk, you’d be crazy not to have a comprehensive policy. The section on how location affects your premium really hits home. Insurance isn’t just a good idea here; it’s essential for survival.